Last week, as expected, EURUSD rallied as expected due to the weakness of USD. However, on Wednesday, the rally was halted and higher prices were rejected with a massive shooting star on Wednesday's close of the daily candle. However, the move to the downside could not reach the previous low, and

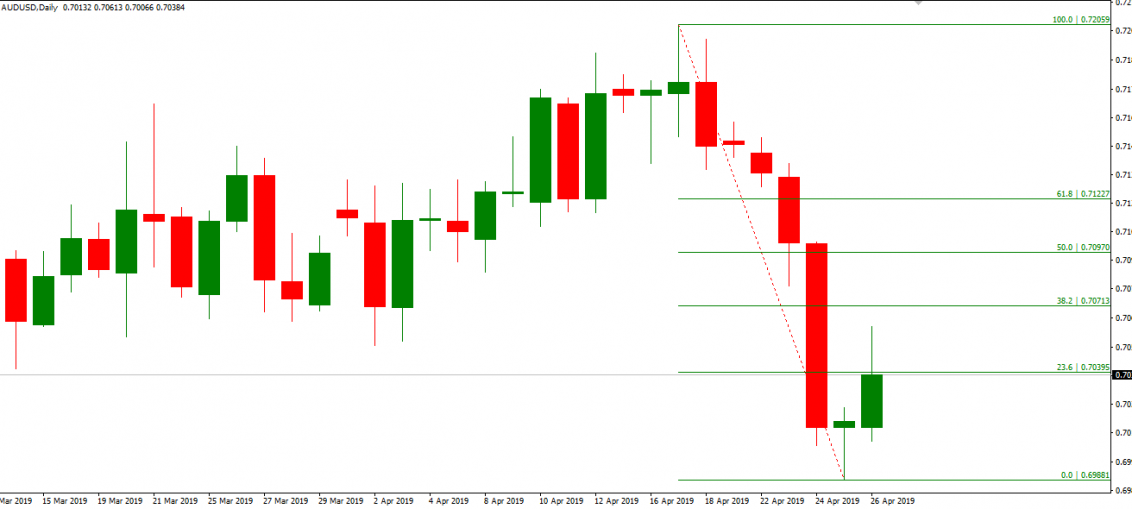

AUDUSD Trading Idea for the coming week of 29-April-2019

EURUSD trading idea for the coming week of 29-April-2019

DXY (US Dollar Currency Index) analysis for the week of 29-April 2019

GBPCHF Sell Opportunity – 24-April-2019

XAUUSD Trading Idea – Inverse H&S – 23 April 2019

CADJPY Trading Idea – 22-April-2019

US Wall Street 30 Index – Short-term trading idea – 22 April-2019

We are looking at an ascending channel. We can see that the market has formed bearish patterns after hitting the resistance, the upper line of the channel. Therefore, we can now expect the market to go looking for the immediate support as shown on the chart. Disclaimer: Our analysis and forecasts given